In July 2025, President Trump and congressional Republicans enacted substantial changes to tax and spending policy. The new law cuts taxes mostly for the wealthy, including billionaires; opens loopholes for big corporations; pays for those cuts by gutting healthcare and food assistance for workers and families, all while raising grocery, utility and other costs; and adds up to $4 trillion to national debt. The highest-income 20% of American households will receive 70% of the tax cuts in 2026, and the top 1%–those with incomes of roughly a million dollars or more–will receive $1 trillion over the next decade. Meanwhile, the funding cuts in the law will result in 17 million people losing healthcare coverage and over 3 million losing nutrition assistance. No Democrat in the House or Senate voted for the law, which polling shows is very unpopular with the American people no matter their political affiliation.

Sources: Joint Committee on Taxation, Senate Finance Committee, Bipartisan Policy Center, & Committee for Responsible Federal Budget

Income Bracket Tax Rate Cut: Costs $2.2 trillion (permanent, no change from 2017)

The 2017 Trump-GOP tax law cut the top individual income tax rate from 39.6% to 37%. A wealthy couple with $2.5 million of income—the average earnings for a household in the top 1%—could get a tax break of up to $55,000 annually just from Trump’s reduction to the top rates.

The top 400 taxpayers alone—who collectively have a reported annual income of $107 billion—get an estimated $800 million tax cut each year just from the reduction in the top rate.

Yale Budget Lab estimates that nearly one-quarter of this tax break would go directly to the top 1% of highest-income households, significantly more than the total amount it would benefit the bottom 60% of households.

Pass-Through Loophole (section 199A): Costs $737 billion (permanent, minor changes)

The 2017 Trump-GOP tax law created a loophole that lets owners of “pass-through” businesses–sole proprietorships, partnerships and S corporations– deduct 20% of their “qualified” income before paying any federal income taxes. That provision was scheduled to sunset at the end of 2025.

Just seven billionaires, including Michael Bloomberg and packaging magnate Richard Uihlein, were able to cut their collective tax bills by almost $200 million in a single year thanks to the pass-through loophole.

Half of the pass-through tax break goes to millionaires, and nearly two-thirds goes to households with over $400,000 of annual income. The 1,000 highest-income tax filers (all with incomes over $85 million) received more than $3.5 billion collectively from the pass-through deduction in 2022 alone.

Yale Budget Lab projects that extending the pass-through loophole gives the average household in the top 0.1% a $107,000 tax cut. The Institute on Taxation and Economic Policy (ITEP) estimates that the top 1% of households gets an average tax cut of $22,500. Both groups agree that the benefit for the median family would be marginal, just $40 to $50.

One study found that just 1-in-4 dollars of pass-through net income was earned by a real small business, and less than 1-in-10 pass-throughs were both legitimately small and employed even a single worker.

The Treasury Department estimates that white households receive 90% of the deduction’s benefit, exacerbating the racial income and wealth gaps.

Weakened Alternative Minimum Tax: Costs $1.4 trillion (permanent, minor changes)

The AMT was created over 50 years ago to ensure that higher-income taxpayers could not substantially or even completely eliminate their federal tax obligations through the exploitation of excessive credits and deductions.

The 2017 Trump-GOP tax law dramatically weakened the AMT making it less effective. Collectively, the number of taxpayers paying the AMT fell from around 5 million in 2017 to just 200,000 in 2018. This provision was scheduled to sunset at the end of 2025.

The Committee for Responsible Federal Budget estimates that about half of the tax benefit from maintaining the weakened AMT would go to households with incomes over $400,000.

Yale Budget Lab estimates that 93% of the tax benefit from this provision would go to the top 10% of highest-income households. ITEP estimates that 85% of the benefit is received by just the top 5% of households.

Doubled Estate Tax Exemption: Costs $212 billion (permanent, minor changes)

The 2017 Trump-GOP tax law doubled the amount the ultra-rich can inherit without paying any tax on the transfer. This provision was scheduled to sunset at the end of 2025 (reverting the exemption threshold to $14 million per-couple), but the bill more than doubles the exemption to $30 million, makes it permanent, and continues to raise it each year with inflation.

The increase will only benefit the richest 0.2% of households, in other words 998 out of 1,000 American families would not get a single penny from this tax cut.

The claim that the estate tax constitutes double taxation is false. Much of the value of the biggest estates is unrealized capital gains which are increases in the value of assets that have never been taxed and will not be subject to any tax other than the estate tax upon inheritance. It’s estimated that over half the value of the biggest estates consists of unrealized income.

This would exacerbate the racial wealth gap since 92% of the beneficiaries of this tax cut are white. There are only roughly 12,500 black and brown households that have more than $14 million of wealth. (Survey of Consumer Finance)

Opportunity Zone Program: Costs $41 billion (permanent, major changes)

The 2017 Trump-GOP tax law created the so-called “opportunity zone” tax break (OZ) which proponents claimed would encourage investment in low-income neighborhoods. However, this tax loophole has been ruthlessly exploited by wealthy real-estate investors. This program has failed to deliver the promised economic opportunity to underserved communities, instead turning many of these neighborhoods into what can more accurately be described as Exploitation Zones. This provision was scheduled to sunset in 2026 but the bill makes it permanent.

Unlike most investment portfolios, Opportunity Zones allow for upfront tax deferral for any capital gains realized if it is immediately transferred to a qualified fund. So if Elon Musk sold Tesla stock with $1 billion worth of gains, rather than paying $238 million in federal income taxes, he could defer paying those taxes for ten years by directing that $1 billion to an OZ fund. Then, the tax on that gain is reduced if the money is held in the fund for as little as five years. Finally, any capital gains derived from the OZ investment itself becomes permanently tax-free if the money is held in the fund for at least 10 years.

Opportunity Zones are designed to benefit big developers, not the existing residents. The special tax breaks disproportionately advantage the richest 1% of households, with the average income of an investor being $4.9 million.

The program operates with little to no oversight. For instance, there are no reporting requirements on economic data such as job creation or poverty reduction. The few existing regulations are so convoluted that an Opportunity Zone fund could put as little as 40% of their money into a designated census tract but still fully benefit from the tax break.

Despite being designed to help distressed communities, most of the investments have flowed to a small number of affluent areas. One study discovered that only 16% of eligible tracts had received any dollars from the program, while the top 1% of wealthiest tracts received half of all investments.

There is a growing consensus in the academic literature that, instead of encouraging new projects, the OZ tax break is a windfall for already planned projects. But in the unlikely case Opportunity Zones do have an economic impact it would likely be worsening displacement in historically Black and Latino communities by accelerating gentrification.

100% Corporate Bonus Depreciation: Costs $363 billion (permanent)

The Federal tax code has long permitted accelerated depreciation, which allows businesses to deduct the costs of equipment more quickly than it actually wears out. But the 2017 Trump-GOP tax law created an extreme version of this tax break, 100% “bonus depreciation,” allowing corporations to write off the entire cost of equipment in the year it is purchased. This provision began to phase out in 2023, but this legislation revived it and made it permanent.

An analysis by Americans for Tax Fairness revealed that a dozen of the biggest corporate beneficiaries of bonus depreciation reaped nearly $43 billion in tax savings from the loophole over the five years it was in effect. Combined, these handful of corporations reported over $1 trillion in pre-tax profits during the same time period, while paying a collective effective federal rate of only 11.6%—far lower than the statutory corporate tax rate of 21% and a lower effective rate than the average American family pays. Over that same time span, these dozen mega-corporations poured hundreds of billions of dollars into non-productive activities that mostly enriched just a handful of ultra-wealthy individuals at taxpayer expense, including $526 billion on stock repurchases, $251 billion on dividend payments, and $6.4 billion on executive compensation.

Two-thirds of the bonus depreciation tax break goes to corporations with over $250 million in annual revenue.

ITEP has reported that 25 mega-corporations saved $67 billion from Trump’s bonus depreciation tax break over five years.

Not only is bonus depreciation an expensive giveaway to the largest businesses, it is also one of the least effective forms of economic stimulus. Moody’s Analytics has estimated that only 27 cents of increased economic activity is generated for each $1 of lost revenue.

Yale Budget Lab estimates that for every $100 of the tax benefits given to corporations, over $60 goes to the richest 1% of households, while the bottom 60% of households receive $5.

ITEP projects that 40% of all corporate tax breaks go to foreign investors. Less than 8% go to non-white households.

Corporate Research & Experimentation Expensing (section 174): Costs $141 billion (permanent)

Corporations have traditionally been allowed to deduct all of their research expenses in the year incurred, even though a lot of research pays off slowly so its costs should similarly be written off over time. Adopting this position, and as a way to partially pay for its big corporate-rate cut, the Trump-GOP tax law decreed that starting in 2022 companies would have to write off research and experimentation expenses gradually: over five years for domestic research, 15 years for foreign. This requirement to “amortize” the expense over time reduces the value of the deduction, increasing corporations’ taxable income and requiring them to pay more in income taxes upfront. The bill retroactively reverses this provision.

Just five mega-corporations (Apple, Amazon, Google, Meta, & Tesla) will be given an immediate $75 billion tax cut.

There is no evidence that spreading out the cost of R&E deductions has any negative effect on corporations’ investment decisions.

Yale Budget Lab estimates that for every $100 of the tax benefits given to corporations, over $60 goes to the richest 1% of households, while the bottom 60% of households receive $5.

ITEP projects that 40% of all corporate tax breaks go to foreign investors. Less than 8% go to non-white households.

Weaken Corporate Interest Deduction Rules (section 163j): Costs $61 billion (permanent)

Corporations are able to deduct costs from revenues to determine the profits they are taxed on. The more they can deduct, the lower their taxable income, the less they pay in taxes. Among those costs are interest payments on borrowed money. The 2017 Trump-GOP tax law limited the corporate interest deduction to no more than 30% of a company’s income generally referred to as EBITDA (earnings before interest, taxes, depreciation, and amortization). This rule was scheduled to become more restrictive in 2022 by applying it to a smaller version of profits called EBIT (earnings before interest and taxes) that excludes amortization and depreciation. The bill retroactively weakens this rule.

Wall Street’s corporate-raider funds—also known as “private equity” funds—are big pools of rich people’s money that buy up companies in the hopes of turning a quick profit. Private equity is a major beneficiary of weaker interest-deduction rules because their business model usually relies on loading up acquired companies with new debt. For instance, when three private equity firms bought Toys “R” Us in 2005, they burdened it with so much debt that within a few years interest payments ate up 97% of its profits. The toy retailer eventually went bankrupt at the cost of 30,000 jobs.

In 2019, Instant Brands—maker of Instant Pot cookers—was acquired by the private equity firm Cornell Capital. In 2021, Cornell forced Instant Brands to take out a $450 million loan to refinance debt from the 2019 acquisition and make a $245 million divided payout to shareholders, of which Cornell Capital received 70%. In 2022, Instant Brands’ EBITDA was a little over $57 million, which means under the looser rules they would be able to deduct up to $17 million in interest expense from their federal tax bill, subsidizing Cornell Capital’s debt-financed payout to itself at taxpayers’ expense. In 2023, laden with interest payments that were likely to outpace their revenue, Instant Brands filed for bankruptcy, throwing into jeopardy the livelihoods of their 1,800 North America employees.

Corporations with over $1 billion in revenue would get half this tax break.

Yale Budget Lab estimates that for every $100 of the tax benefits given to corporations, over $60 goes to the richest 1% of households, while the bottom 60% of households receive $5.

ITEP projects that 40% of all corporate tax breaks go to foreign investors. Less than 8% go to non-white households.

Changes to International Tax Rates and Rules: Costs $167 billion (permanent)

This section of the tax package primarily weakened a trio of interlocking corporate tax provisions created under the 2017 Trump-GOP tax law—the Global Intangible Low-Taxed Income (GILTI) deduction, Foreign-Derived Intangible Income (FDII) deduction, and Base Erosion Anti-Abuse Tax (BEAT)—that were scheduled to become more strict in 2026.

The Foreign-Derived Intangible Income (FDII) deduction was enacted in the 2017 Trump-GOP tax law under the faulty assumption that it would incentivize corporations to keep intangible assets like patents and copyrights onshore. But in reality the FDII loophole has created a perverse incentive for corporations to shift investments overseas. That is because FDII is defined as domestic profits from selling to foreign markets minus 10 percent of the value of tangible assets–such as factories, buildings, or machinery–held in the United States. Thus a corporation’s tax break goes up the less physical investment they have onshore.

The FDII loophole heavily favors multinationals, particularly those–like tech companies and pharmaceutical firms–that are heavily reliant on intangible assets like licenses and patents. Just 15 mega-corporations, including Google, Facebook, and Amazon, alone reaped over $50 billion of tax breaks from the FDII loophole over its first six years.

The FDII deduction was scheduled to drop from its current 37.5% to 21.9% starting in 2026. That would make the effective tax rate on “foreign derived income” rise from 13.1% to 16.4%, closer to yet still far below the domestic 21% corporate rate. Under this new law the FDII deduction is set at 33.3% resulting in an effective tax rate of just 14%

The Global Intangible Low Tax Income (GILTI) currently taxes foreign corporate income generated from intangible assets—such as patents, trademarks and copyrights—at just 10.5%, half the 21% rate on domestic income. That minimum rate was scheduled to modestly increase to 13.1% starting in 2026, but Republicans actually raised this rate to 14% matching the FDII rate

Corporations also dodge taxes through fabricating offshore deductible expenses—like interest or royalties—paid to foreign subsidiaries. This lowers the parent company’s taxable income in the United States where it would in theory be subject to a 21% corporate tax, and raises the income of the subsidiaries often located in tax havens where they pay little or nothing. To combat this “earnings stripping” the 2017 Trump-GOP tax law created the Base Erosion Anti-Abuse Tax (BEAT), which applies to multinational corporations with annual gross receipts over $500 million that also claim excessive deductions from foreign jurisdictions. The BEAT rate is currently set at 10%, but was scheduled to increase to 12.5% starting in 2026. Under this new law the BEAT rate was rolled back to just 10.5%

Tax Exemption For Tipped Income: Costs $31 billion (expires 2029, NEW)

Fewer than 5% of low-wage workers – those earning less than $25/hr – receive tips. Even among that group, over one-third do not make enough to owe federal income taxes anyway. So almost no low-wage workers would see any benefit from this proposal, even as it distracts from real solutions to underpaid employees.

Abolishing the sub-minimum wage paid to tipped workers in many states and enacting the “Raise the Wage Act” which would raise the minimum wage to $17 an hour. These would be the quickest and easiest way of raising low-paid worker income. Right now tipped workers make significantly less than non-tipped workers, $538 per-week versus $1,000 per-week. This disparity could get even worse if employers are incentivized to classify more of their workers as tipped employees to avoid taxes.

While the average service worker would see little to no benefit from this proposal, high-priced CEOs, money managers, lawyers, and other professionals could dodge millions of dollars in taxes by simply re-labeling their fees as “tips.” The proposal would do nothing to prevent this kind of gaming of the system by the nation’s highest-paid employees. It has been proven time and time again, that when specific forms of income gain preferential tax treatment.

Tax Exemption For Overtime Income: Costs $89 billion (expires 2029, NEW)

If overtime pay was exempt from taxes, the highest-income families would get over 50% of the tax benefit, while the lowest-income families would get less than 1%. But this likely underestimates the distributional benefits, because employers would be incentivised to restructure compensation to classify more income as “overtime” to reduce how much they have to pay in taxes. Corporate executives who love to claim they work long, grueling hours could get a massive tax windfall on their multi-million dollar pay packages by reclassifying their income.

One of the greatest achievements of the American labor movement was the creation of the 40-hour work week, but this would undermine the time off workers have earned and deserve. Many low-income workers might feel pressured to work excessive hours to benefit from tax-free earnings, leading to many health and quality of life issues. Some businesses might manipulate schedules to classify more hours as “overtime” reducing their payroll tax obligations while overworking employees. Instead of hiring additional workers, employers might push existing staff to work more overtime, reducing job creation in favor of exploiting a smaller pool of workers.

Implementing such an exemption would add unnecessary complexity to the tax code. Businesses would need to track and report overtime earnings separately, creating administrative burdens. The IRS would need additional resources to prevent abuse. Workers might also struggle to correctly report exempt vs taxable income, leading to errors and more audits.

Last year the Biden Labor Department made a massive improvement to overtime compensation rules that would have given multi-billion dollar pay raises each year to over 4 million workers. But President Trump’s transition team and Labor Department plans to water down this rule, resulting in millions of workers losing access to overtime and increased pay.

School Voucher Tax Credit: Costs $26 billion (permanent, NEW)

The bill creates a new dollar-for-dollar tax credit to subsidized school vouchers of up to $1,700. This will be a massive windfall for the wealthy and creates an enormous capital gains tax loophole, all while undermining the public school system.

Currently, vouchers overwhelmingly support wealthy parents who are already sending their children to private school, so this would effectively be a looting of the public school system to send a few more rich kids to fancy schools.

Private education vouchers were rejected by voters at the ballot box in three states – Colorado, Kentucky and Nebraska – because they do not promote educational achievement, nor are they viable options for low-income students or rural students.

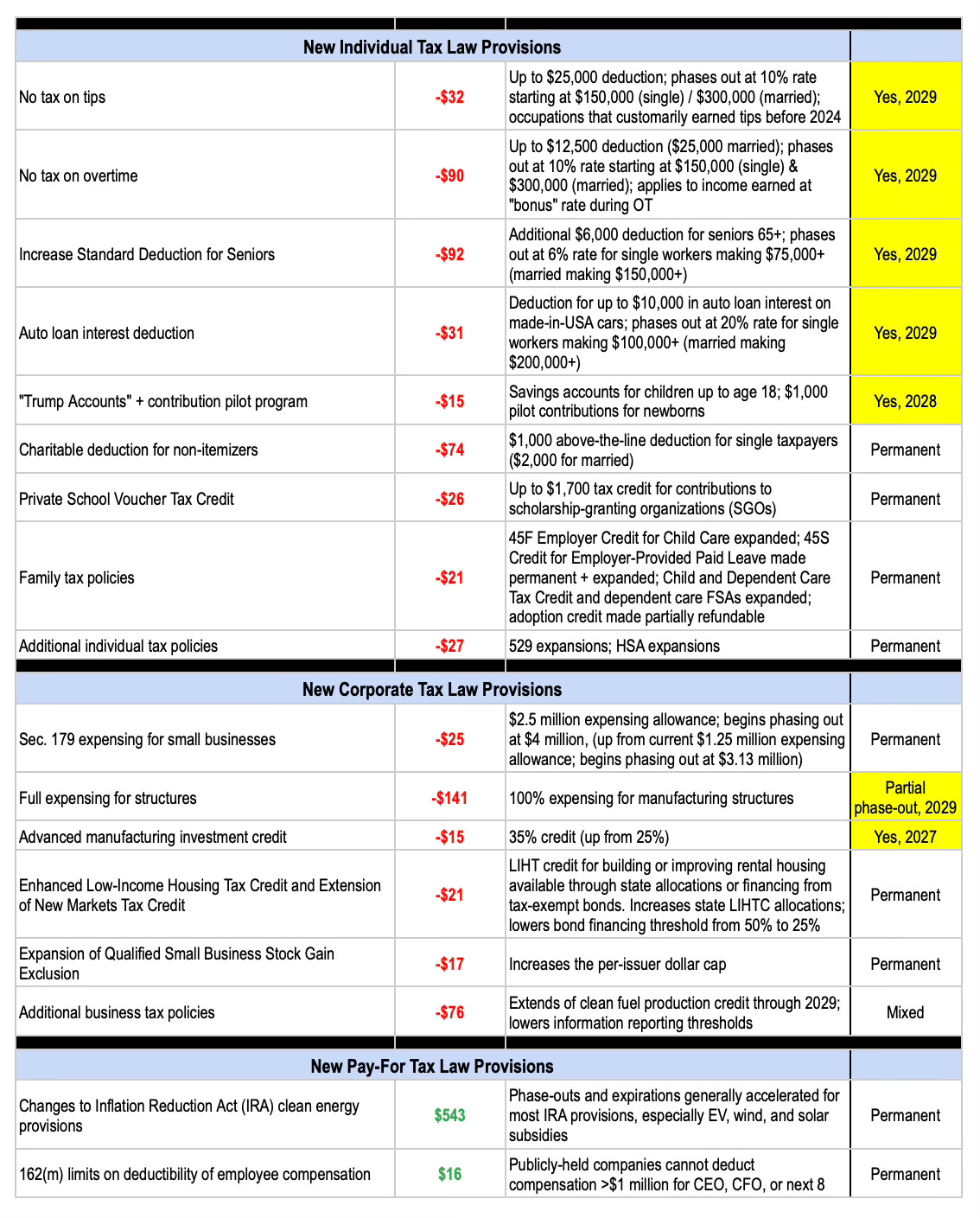

Oh wow—I’ve got a sole proprietorship in pet care; can’t wait to get all that pass-through credit on poop bags! Seriously though, this is a very clear and helpful post, particularly the chart, which shows how many of the popular *goodies* like taxless tips and overtime are set to sunset once the working class gets used to them.