Congress should raise, not cut, corporate taxes in the lame-duck session

Congress is considering giving corporations BILLIONS in tax breaks in its year-end bill. The ten-year cost could be up to $600 billion.

But Corporations are already raking in their highest profits since 1950, and some are paying $0 in federal income tax. They don’t need another tax cut.

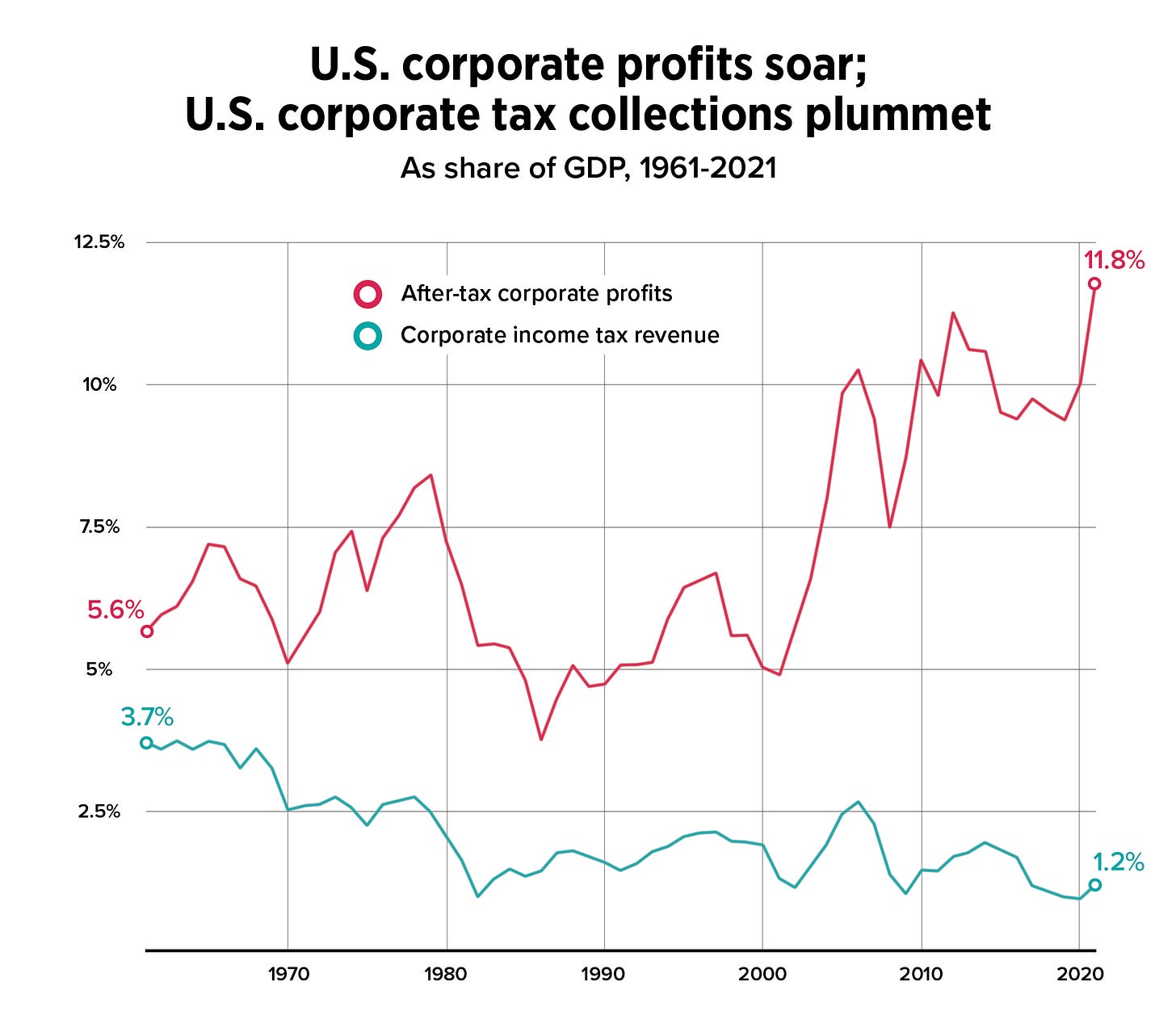

While inflation squeezes working families, corporations are doing better than ever. Last year, corporations raked in their highest profits and paid the least taxes since 1961.

But corporations are waging a massive lobbying campaign to get MORE tax cuts.

Why? Republicans’ 2017 tax scam gave corporations a 40% federal income tax cut. They also got three other big tax breaks that are set to expire this year. The legislation being considered in Congress would extend them.

What’s worse? Some of the corporations set to benefit the most from one of these tax breaks make the highest profits and pay the lowest tax rates, like Amazon, Ford, Netflix and Verizon.

And while the average American pays a 13% federal income tax rate, corporations on average are paying a much smaller share of taxes than they were just a decade ago. In 2020, 55 corporations paid $0 federal income tax on $40 billion in profits.

The potential $600 billion could fund a 4-year renewal of the expanded Child Tax Credit, which lifted nearly 3 million kids out of poverty last year. Instead, Republicans are insisting on cutting taxes for corporations and threatening Social Security and Medicare.

Democrats JUST passed the Inflation Reduction Act to make billion-dollar corporations pay a 15% minimum tax. Congress must not turn around and give away even more in corporate tax breaks. Voters didn’t vote for that. They want corporations to pay their fair share.

Corporations have been reaping the benefits of special treatment for too long. They should be paying MORE of their fair share, not getting tax breaks while we pick up the tab.

Tell Congress: Raise, don’t cut, corporate taxes during the lame duck session!