Even As Billionaire Wealth Surges After Trump’s Election, New GOP Leader Aims To Give Them $2.7 Trillion Tax Break

America’s Top Plutocrats Are Now Worth A Record-Breaking $6.7 Trillion, Yet Republicans Under New Senate Chief Thune Want To Eliminate Estate Tax

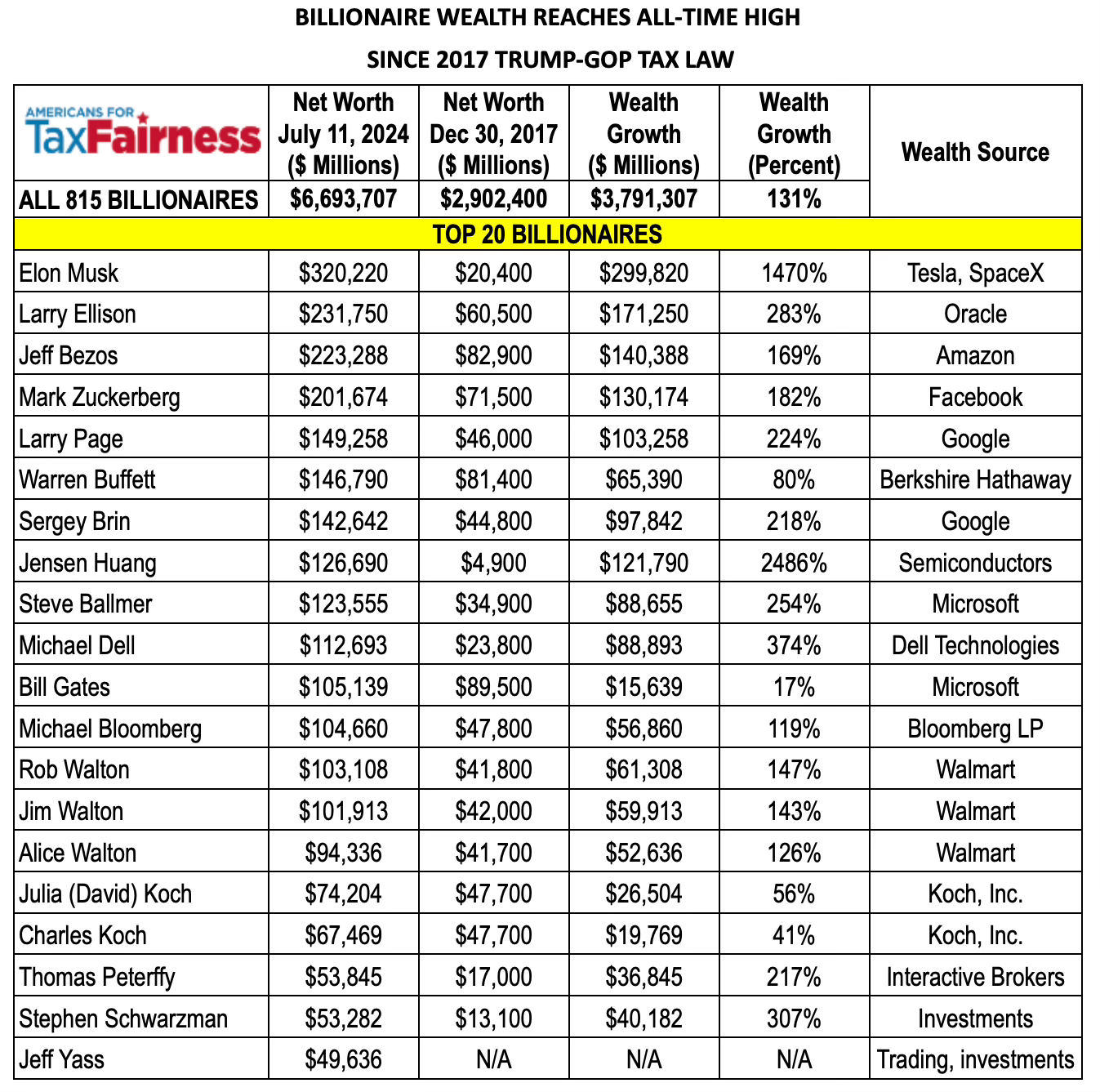

The results from November's election are in and the clear winners are America’s 815 billionaires. They now hold a record-shattering $6.7 trillion of our national wealth, according to a new analysis of Forbes data by Americans for Tax Fairness (ATF). Just between the day before Election Day (Monday, November 4) to a week after the voting deadline (Tuesday, November 12), billionaire wealth jumped $276 billion, with 20% of the gains going to Elon Musk, who alone saw his personal wealth grow by an astounding $57 billion in a week. Now Republicans have promised to protect and expand those riches through more tax cuts.

Among the tax handouts the GOP hopes to offer America’s plutocrats is a weakening or elimination of the estate tax, the federal government’s only curb on dynastic wealth. As proof of the party’s intent, the new Republican majority in the U.S. Senate has chosen as its next leader the chamber’s main champion of estate-tax repeal, John Thune (R-SD). A very rough estimate is that elimination of the estate tax would save billionaire families around $2.7 trillion of their massive wealth–and deprive working Americans the exact same amount of funding for vital public services like Medicare, child care, education and housing. (That figure is derived by applying the top 40% estate-tax rate to the billionaires’ total $6.7 trillion of wealth. This is a low estimate because the estate tax will not come due for some billionaire families for decades, over which time their wealth will almost certainly keep rising.)

Total billionaire wealth has surged by $3.8 trillion – or 131% – just since the enactment of the Trump-GOP tax law seven years ago. That tax package was heavily rigged for the very wealthy, making our tax code more regressive and our economy less fair. While President Trump and Congressional Republicans promised their tax law would give every family in America at least a $4,000 increase in their take home pay, that windfall never arrived.

Source: Americans for Tax Fairness

Instead of addressing the nation’s growing economic inequality and the growing shortfall in federal revenue, President Trump and Congressional Republicans plan to make the situation even worse by enacting a new tax-cut package that gives billionaires tax breaks on the backs of working people. This Republican tax plan will start with extending all the expiring provisions in the 2017 Trump law–which alone will balloon the federal debt by $5 trillion over the next decade–but will likely include new handouts to the very wealthy, such as elimination of the estate tax.

Abolishing the estate tax would only benefit the 1-in-500 ultra-rich families who pay it: this year, a couple must be worth over $27 million to owe even a penny, and that number goes up annually with inflation. Yet getting rid of the estate tax would hurt everyone who won’t inherit a fortune by reducing federal revenue by hundreds of billions of dollars and thereby threatening funding for important public services and adding more to the public debt. Eliminating the estate tax would just be the latest and final act of Congressional Republicans who have spent much of the last three decades chipping away at it, turning a once robust tool for breaking up dynastic wealth and fostering economic mobility into a pale shadow of its past self.

Despite the anti-estate-tax propaganda we constantly hear, the reality is only billionaires and multi-millionaires would benefit from the further weakening or elimination of the estate tax.