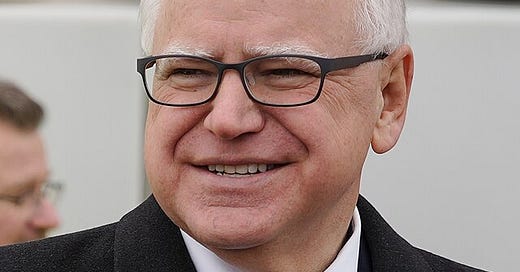

Feds Should Emulate Walz’s State Record of Taxing the Rich to Invest in Families

As governor of Minnesota, Tim Walz demonstrated how fairer taxes on the wealthy can fund needed investments in working families. It’s an approach federal policymakers should follow.

By William Rice

As governor of Minnesota, Tim Walz has demonstrated how fairer taxes on the rich and corporations can help fund needed investments in working families. It’s an approach federal policymakers would be wise to follow.

Among the progressive tax reforms Governor Walz has signed into law are:

A 1% surtax on investment income over $1 million. It’s a common-sense proposal for income the already wealthy receive in the form of interest, dividends, capital gains and other versions of “money making money” be taxed at a higher rate than the income that comes from working a regular job. Thanks to Walz’s legislation, Minnesota is the only state in the nation that taxes investment income at higher rates than wage income. Some states even tax passive income at lower rates than work income. And the federal government grants a nearly half-off tax discount on the most prominent forms of investment income, capital gains and dividends.

Limits on high-income deductions. Deductions reduce taxable income, thereby indirectly cutting tax bills. But deductions favor high-income households because they are more valuable at higher tax rates. For someone paying a 10% tax rate, a $100 deduction saves $10 in taxes. But for someone paying 25%, that same $100 deduction offers a $25 saving. One way to reduce the tilted-to-the-rich aspect of deductions is to reduce their value at the highest income levels. Walz’s reform did just that, limiting deductions modestly for households making well over $220,000 and more aggressively on incomes over $1 million.

Fairer taxes on business income. Before the Walz reforms, companies in Minnesota didn’t pay taxes on the great bulk of income they received from the companies they owned. Now they pay taxes on at least half of that subsidiary income. The reforms also increased taxes on the foreign profits of Minnesota corporations, raising revenue while promoting domestic production and employment.

Altogether, the Walz tax reforms on high-income households and big businesses will increase state revenues by over $1 billion over two years. Equally important, he’s using that new revenue to help raise incomes and improve public services for working families. Among those investments are:

The biggest child tax credit (CTC) of any state. Families making up to about $96,000 can take a credit of up to $1,750 per minor child. Minnesota’s CTC is also—unlike most other states and in stark contrast to the federal CTC—fully refundable, meaning those families with the lowest incomes and greatest need are included in the program.

Free school lunch and breakfast for all students. Minnesota became one of only a few states offering free meals to all schoolchildren. This important reform ensures all kids are getting enough nutrition in school, reduces paperwork and red tape, and ends any stigma that could be attached to selective charity.

Free tuition at state colleges for students from working families. Students from households with less than $80,000 of annual income may receive tuition assistance from state and federal programs. Walz implemented a program that covers any balance that remains after they’ve received this state and federal assistance. It covers attendance at Minnesota state colleges and tribal colleges.

Up to 20 weeks of paid family and medical leave. Workers with as little as $3,500 in wages over the previous year will be eligible for the program, which covers medical (including pregnancy-related) leave for the employee, in addition to time off to care for loved ones, bond with a new child, and to deal with the impact of military deployments. Lower wage workers would receive 90% of their regular wages while on leave. The program will eventually be paid for with a payroll tax split between worker and employer.

Exempting Social Security benefits from state taxes on all but the highest-income Minnesotans. Households with incomes below $100,000 will no longer owe any state tax on Social Security benefits, and those with incomes up to $140,000 will get a state-tax discount.

Raising taxes on the wealthy and corporations and then using the revenue to improve the well-being of working families is a winning combination from any perspective. It narrows economic inequality, reduces the need for public borrowing, and invests in the social goods—well-fed children, affordable education, a healthy work-life balance—that create thriving communities.

This tax-and-invest strategy is also extremely popular all along the ideological spectrum. In just one example, a recent national survey found that over three-quarters (77%) of those polled favored taxing the rich and corporations to pay for needed investments in the “care economy,” which includes child care, elder care, care for disabled individuals, and paid family and medical leave. Supporters included a strong majority (59%) of Republicans.

Minnesota’s bold program of fairer taxation and public investment should be a model for the United States. Next year’s debate over the fate of the expiring Trump tax cuts will offer a perfect opportunity to craft just such a program for our nation.